How to create an ESG report people actually want to read.

Complex and confusing language. Dull, dry data. Walls of endless text. No, we’re not talking about the IRS tax code or lengthy legal documents. We’re talking about the average ESG report. With rising pressure to disclose more data around their environmental, social, and governance efforts, many companies end up publishing reports that allow them to check a box but aren’t very interesting to read. And they’re missing a huge opportunity to tell their sustainability story.

Instead of aiming for “good enough,” entice your audience with authentic, emotional stories that build trust. When backed with relevant data and facts, the result is a report that not only demonstrates the value of your ESG efforts, but inspires readers to support and contribute to your brand’s initiatives.

Six steps to planning and developing engaging ESG reports

With a solid content strategy and compelling narrative, you can take your ESG reporting to new heights. Here’s how to do it.

1. Gather your inputs

Because you’ll need to compile lots of data from multiple sources, the earlier you start gathering these inputs, the better. At Right On, we conduct content strategy workshops with our clients eight months or more in advance of publication to be sure we’re aligned on the report content, and allow plenty of time for research, interviews, and approvals.

Prior to the workshop, we ask those experts to fill in pre-workshop questionnaires covering achievements, challenges, and other highlights to help guide our discussions. The idea is to identify the major areas that need to be covered in the report, knowing that details will come later.

With all of these inputs as a foundation, developing the content strategy brief goes much more smoothly.

Strategic questions:

- How early can we start gathering content for our next report?

- Which leaders should participate in our content strategy workshop?

2. Create your blueprint.

One thing to keep in mind as you begin the reporting process is that your ESG strategy and content strategy aren’t the same. Your ESG strategy defines the environmental, social, and governance topics that are most important to your organization, as well as your goals and how you’ll achieve them. On the other hand, a content strategy brief is the blueprint that helps you report on those ESG efforts.

Your content strategy brief should include elements such as:

- goals for your report

- your audience and what they care about

- the theme you want to carry throughout the report

- the main message you want to get across

- points and stories to support that message

- listing of resources and subject matter experts to help you build those stories

Most of the information to create your brief should come from your workshop discussion and pre-workshop questionnaires. In addition, you should include a high-level or detailed outline depending on what makes the most sense for those who review the brief. It’s important to get approval from all stakeholders at the brief stage so you can confidently move forward with the rest of the reporting process.

Strategic questions:

- What are our goals for this year’s report?

- Which topics and data will help us best tell our ESG story over the past year?

3. Write for your readers.

From customers and employees to shareholders and analysts, your ESG story has to speak to a variety of audiences with differing needs and interests. That’s why it’s important to define your audience as part of your strategy brief. For example, while investors and raters might want to see more data and straight facts, employees and consumers are more likely to relate to stories around how your efforts impact people, company culture, and their communities.

In the example below, you can see how Farmer Brothers strikes a nice balance between providing hard numbers and human stories. Not only do they present readers with stats on how reducing truck transportation saves fuel, but they tell stories about how their efforts have impacted coffee growers around the world.

Offering different formats such as interactive web versions of your reports, a high-level ESG summary, or more in-depth reports on specific topics can also help you reach different audiences with content that resonates.

Strategic questions:

- Who are our stakeholders? (customers, employees, potential employees, investors, raters and rankers, analysts)

- What do each of these groups care about most?

4. Tell the stories behind the numbers.

While data is essential to demonstrating progress, telling the story behind that progress makes your report more relatable to readers and demonstrates the authenticity of your brand.

“Sound science ensures the integrity of a message, but human beings find meaning in stories, not acronyms and technical jargon,” says Elsa Wenzel in a recent GreenBiz article. “Climate communicators can consider telling stories about cherished people and places—not just for ‘future generations’ but for those facing climate-related challenges right now.”

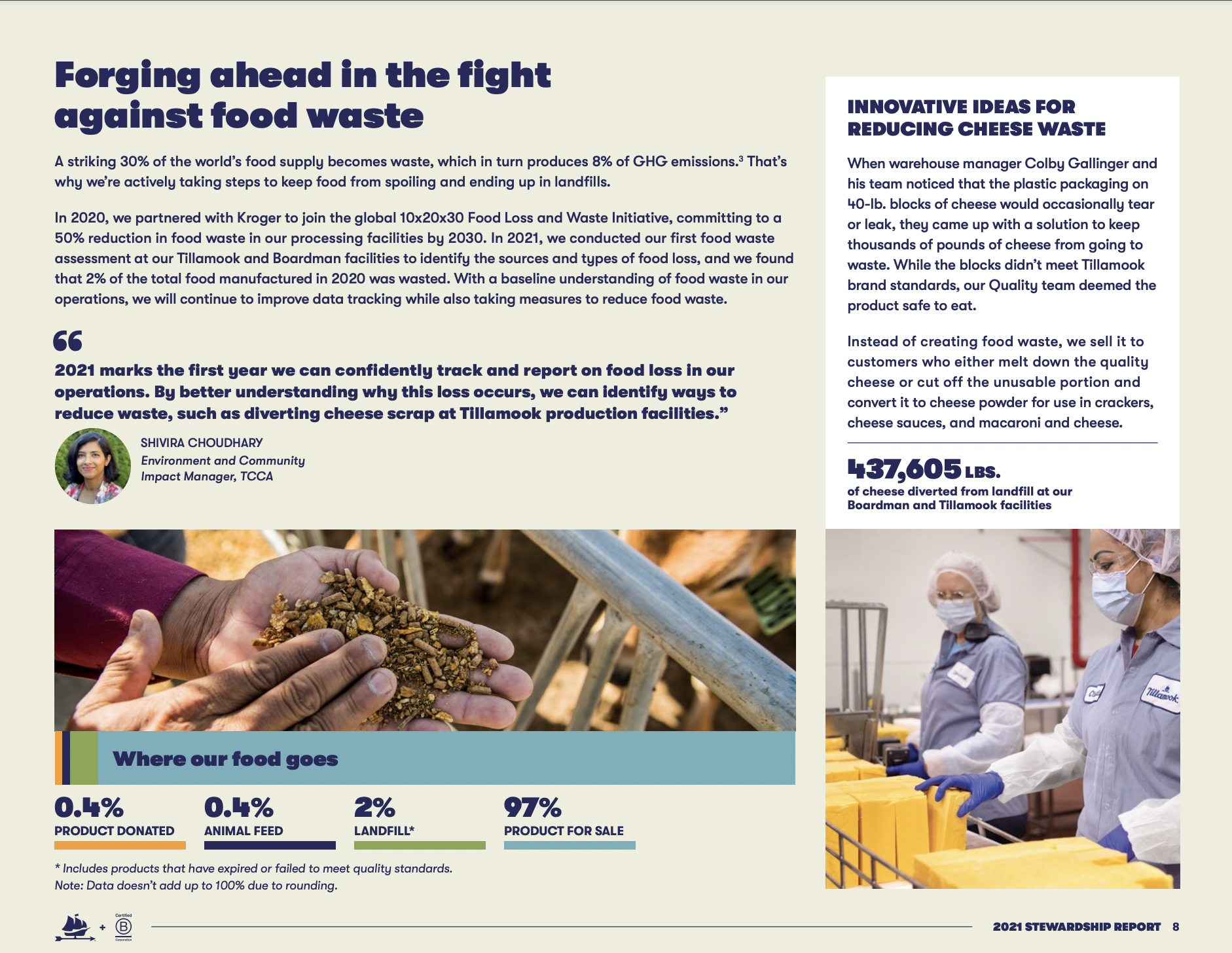

Tillamook does a great job of sprinkling stories throughout their report to keep readers interested. For example, instead of just reporting that they diverted 437,605 pounds of cheese from landfills, they describe how they achieved it with a personal story. In the example below, you can see how they keep the report both credible and engaging by including a mix of stats, quotes, stories, and visuals.

Strategic questions:

- What are some of the biggest achievements we want to highlight in this year’s report?

- Are there any stories we can tell that help illustrate how we made this progress?

5. Turn your shortcomings into strengths.

While we all love reporting on progress, providing a balanced narrative of both positive and negative impact goes a long way in building trust with your readers and telling a complete ESG story. In fact, talking about your vulnerabilities can make your stories even more relatable and engaging.

“Perfection isn’t necessarily interesting, but struggles are inherently compelling,” says Diana Kightlinger, a senior writer at Right On and a GRI-certified writer for companies supporting and reporting on sustainability. “Look for a story in your shortcomings and share where you are and where you hope to go.”

“Perfection isn’t necessarily interesting, but struggles are inherently compelling.”

—Diana Kightlinger, senior writer, Right On

To find those stories, Diana recommends looking at your data to see where you didn’t achieve your goals or aren’t on target, share the actions you’ve taken so far, and acknowledge where you still have more work to do.

Strategic questions:

- Are there areas where we’re not making as much progress as we would like?

- What work have we done so far in these areas, and what actions do we plan to take to meet our targets?

6. Layer in human voices.

Interspersing quotes throughout your report is one of the best ways to keep readers engaged. Not only do these voices bring your strategy and initiatives to life, but they also provide an emotional connection. However, quotes aren’t the only way to make your reports more human.

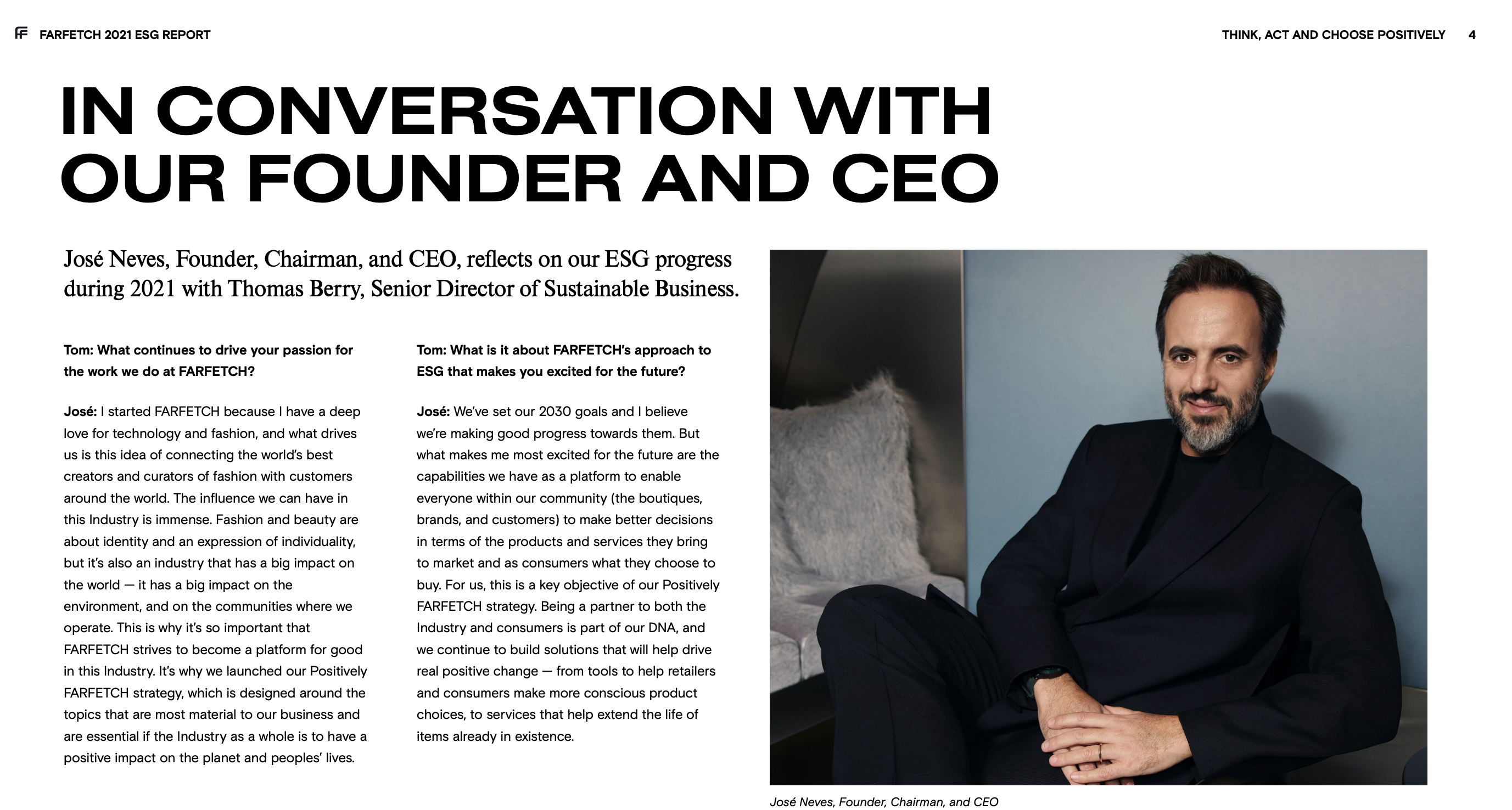

For example, rather than simply publishing a CEO letter at the front of their report, FARFETCH takes a friendlier approach. The company uses a Q&A format accompanied by an image that makes you feel like you’ve been invited to a conversation between their senior director of sustainable business and the CEO. This format would also work well with your board letter or message from your chief sustainability officer.

You can also experiment with adding audio or video snippets throughout your report to change things up a bit.

Strategic questions:

- Where are there opportunities to bring in voices from employees, customers, suppliers, or other stakeholders?

- Are there quotes that lend themselves to audio formats, or stories that are better told through video?

Uncover your story. Tell it well.

ESG reporting that speaks to people’s hearts and minds isn’t easy. It takes months of strategic thinking, collaboration, interviewing, writing, and approval processes. And it means uncovering the stories that many others might not see.

But with your strategy to guide you, and your audience to keep you focused, you can make your ESG story one worth telling—and worth reading.

Our Most Recent Insights.

SEE ALL INSIGHTS →

Uncategorized

A more hopeful Earth Day

When it comes to climate messaging, we’ve learned that stories of hope and optimism inspire action.

Reporting

CEO letters that sing (sometimes literally).

Break free from the standard CEO letter format—and create a standout opener for your next sustainability report.

Storytelling

Human stories, not corporate soliloquies.

You’ve got strong DEI commitments and you’re taking action on them. Now, you need compelling, human-centric content that changes hearts and minds.